Annual 401k Contribution Limit 2024 – The Internal Revenue Service (IRS) sets an annual limit on the amount of your personal contributions, also known as your salary deferral, for your retirement plan savings. The limits for 2024 are . Increasing contributions to your 401(k) or IRAs can get you there, but you should be aware of the limits. The IRS sets annual caps on contributions to both workplace and individual retirement plans. .

Annual 401k Contribution Limit 2024

Source : www.guideline.com401(k) Contribution Limits in 2024 Meld Financial

Source : meldfinancial.com401k Contribution Limits For 2024

Source : thecollegeinvestor.com401(k) Contribution Limits in 2024 Meld Financial

Source : meldfinancial.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com2024 Contribution Limits Announced by the IRS

Source : www.advantaira.comIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.comHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.com401(k) Contribution Limits in 2024 Meld Financial

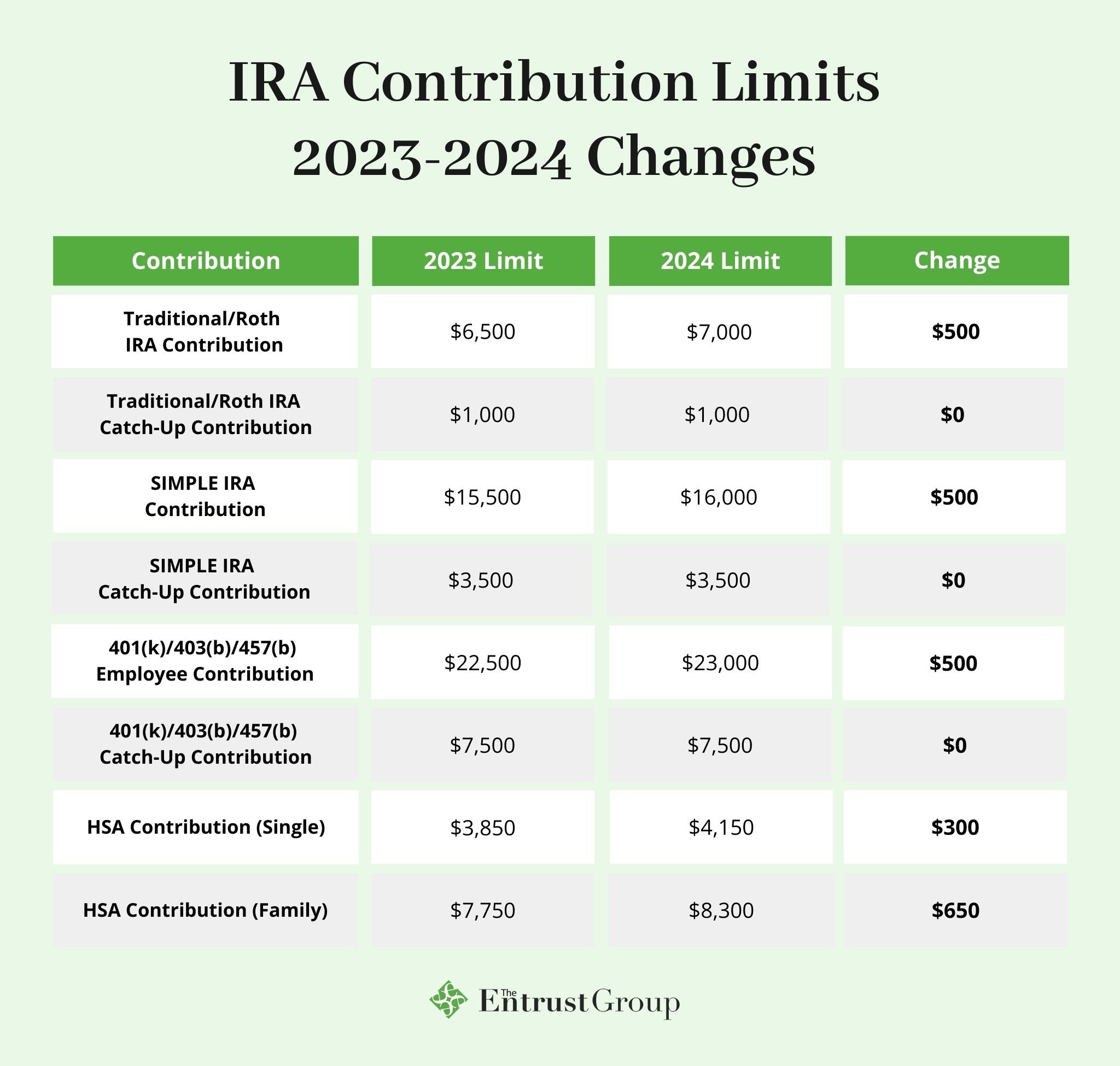

Source : meldfinancial.comAnnual 401k Contribution Limit 2024 401(k) Contribution Limits in 2024 | Guideline: The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . contributions to all accounts can’t exceed the annual 401(k) limit. Rob DeLucas, a certified financial planner for Afton Advisors in Brentwood, Tennessee, says, “A Roth 401(k) strategy actually .

]]>